Table of Content

A business insurance agent can help you work through these questions to determine where your business may be vulnerable, and where home-based insurance business can help. This would be good for a very small business with annual sales around $5,000 or under. A home insurance policy usually excludes coverage for “other structures” that are used for business purposes, such as a detached garage where you run the business. While starting a home-based business is an exciting endeavor, new entrepreneurs may be unaware of the risks involved.

You can also add optional Business Income for Off-Premises Utility Services coverage. This helps cover a loss of business income from an interruption in utility services. You can get better home-based business insurance from either an endorsement to your homeowners insurance policy or as a separate business insurance policy. How much it costs to insure a home business can vary and also depends on the size of the business. You can typically add a home business endorsement to your policy for an additional $25 annually to increase your coverage limits from $2,500 to $5,000.

Do I need insurance for a home business?

To find out what insurance you need, take the time to sit down with your agent and talk. There is loss-of-income insurance, business personal property insurance, personal and advertising injury insurance, on-premise liability, and off-premise liability to consider. If you give advice or write software, you should consider errors and omission (E&O) insurance, which will cover you if you are sued over an error.

Wondering if home business insurance is a necessary step beyond regular homeowners insurance? As more and more people find ways to turn their home and property into a business of some sort, this question comes up often. If your home business is something along the lines of blogging on memories of your childhood, your business inventory may consist of a laptop, and you certainly need a roof over your head to do your work. Our home based business insurance policies are underwritten by the RLI Small Commercial Business Group.You can find applications, rates and marketing materials here. The RLI Home Business Insurance policy, specifically designed for home-based businesses, crafters and hobbyists, is written on an ISO BOP form.

Macquarie Insurance Facility Specialist - Europe

If you’re temporarily or permanently working from home but your laptop and other work equipment are owned by your employer, they will usually cover the cost of replacing it if it’s stolen or you misplace it. But if you are the owner of an at-home business or you have personal computers that you used for work, you’ll likely need some form of home-based business coverage. However, to obtain proper customer coverage, such a consultant must still interact with authorized brokers or agents. Moral hazard is the idea that an insurance firm can unintentionally discover that its insureds are not necessarily as risk-averse as they might be . This "insulates" people from the total costs of risk-taking, undermining risk-reduction or risk-adaptation strategies and prompting some to label insurance programs as possibly maladaptive.

Home business insurance can help protect the things you need to run your company, typically with higher limits than homeowners insurance. If you’re looking for extra coverage because you're self employed or have an at-home business, you typically have three home business insurance options. Which coverage you need will depend on how much work equipment you have, what your job is, and the size of the business. Up to $100,000 in business personal property limits for protection at home and while temporarily off premises.

Looking for a job?

There may be other endorsements that can be added, depending on your state and the company. And, it may not cover higher numbers of customers coming on to the property that the business owner is hoping for. A BOP policy does not include workers compensation, health or disability insurance, professional liability exposures and commercial automobile coverage.

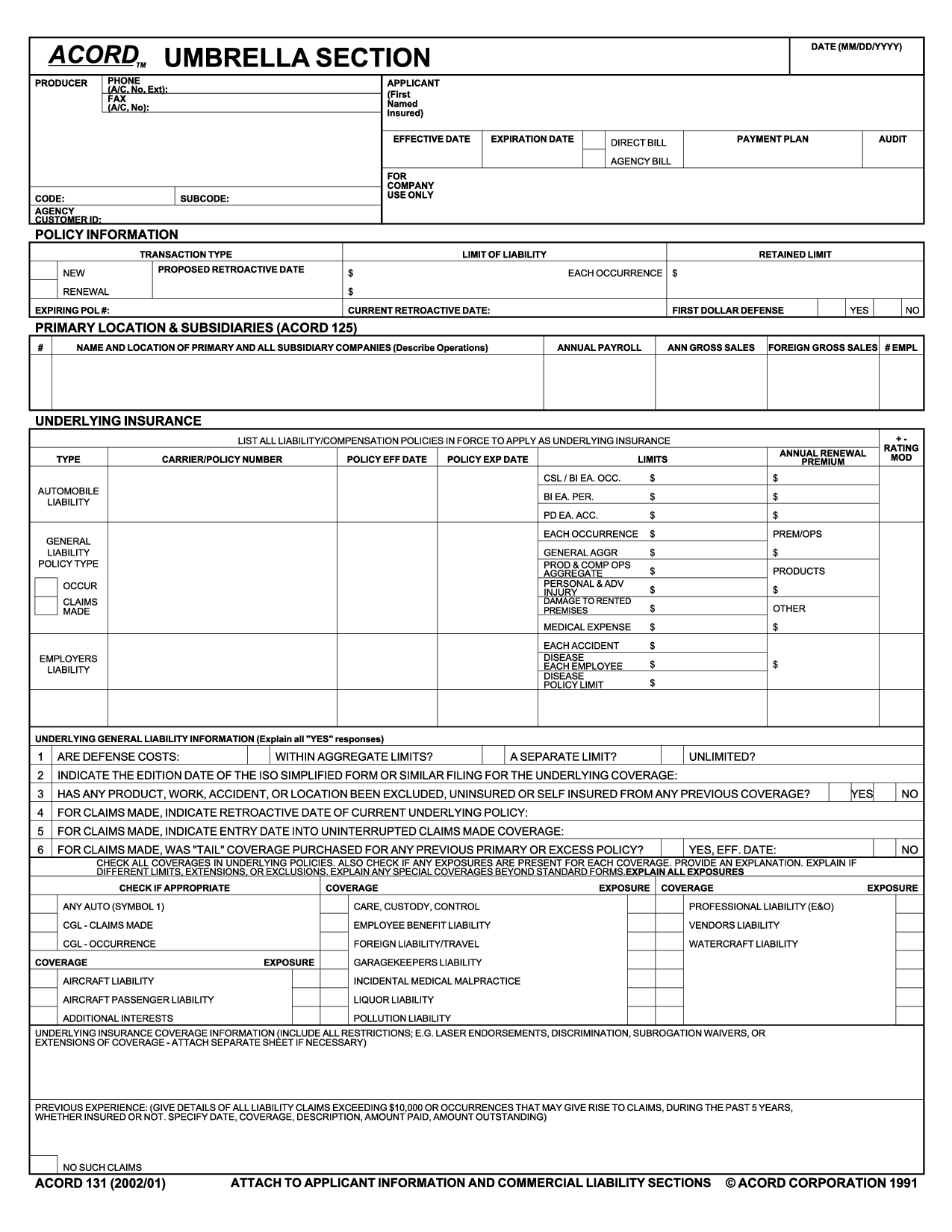

Home insurance companies typically offer endorsements that you can add to a homeowners policy to get more business coverage. An umbrella policy increases your liability limits beyond the amount in your underlying policy. One caveat to keep in mind — your umbrella coverage won’t supplement business losses that aren’t covered by your homeowners insurance. In order for your umbrella insurance to take effect for your business, you need to make sure the business-related loss is covered under an existing home business endorsement or policy. Should one of your employees become injured while on the job, your business insurance won’t compensate them for lost income. You’ll need to add workers compensation coverage to your business to protect your employees.

Get acquainted with your agent or broker.

Public Liability cover can help with costs arising from injury or property damage sustained by clients while they visit your home office. For example, if someone trips over your laptop bag and injures themselves. An AAMI Business At Home policy can combine cover for your home and business into one convenient policy. Any advice here does not take into account your individual objectives, financial situation or needs. Before making a decision about this insurance, consider the relevant Product Disclosure Statement /Policy Wording and Supplementary PDS . Where applicable, the PDS/Policy Wording, Supplementary PDS and Target Market Determination for this insurance are available on this website.

Around 2 out of 10 home businesses take in more than $100K per year. If you've invested in rental properties, you may be able to deduct your mortgage interest, mortgage insurance premiums, and any energy-efficient upgrades you've made to the property from your taxes.

And it often has higher limits for off-premises business property and equipment-breakdown protection, as well as supplemental theft coverage. Some allow coverage for businesses that have up to three full-time workers. Stand-alone business insurance policies can offer more robust coverage and with higher coverage limits. This type of policy can provide better coverage limits for business equipment and liability over a typical home insurance policy endorsement. For some, though, it appears adding a separate home business insurance is the next step if their business starts expanding into having higher cost inventory and more equipment that needs protecting. And just as important if not more so, also for liability when customers, especially in larger numbers, start coming to the property or are consuming the goods from that home business.

In essence, insurance is a contract represented by insurance companies and provides a customer with financial protection or recompense by an insurance company in the event of specified failures. Or perhaps you sell handmade jewelry online using plant materials preserved in resin. You buy new supplies monthly and don’t store a lot yourself, and you get plant materials far and wide, not only on your own property. You make the jewelry only after it’s been ordered, so there isn’t a lot of inventory of your craft in storage, either.

Homeowners insurance is meant to protect your home and personal possessions. Juan Cruz is the Director of Marketing at Inszone Insurance Services. He joined the company in 2016, bringing with him over 7 years of experience in direct response Marketing. Juan holds a Bachelor’s degree in Global Studies as well as a minor in Anthropology from the University of California Los Angeles .

While standard homeowner endorsements offer some coverage, many DO NOT cover most business-related losses. Whether you need any or all of these policies will depend on the results of your risk assessment. There are an unlimited number of ways that businesses may find themselves on the receiving end of a lawsuit or claim, and business insurance provides a buffer for the business to prevent financial ruin. For interior decorators who run their services out of their home, you’ll likely need home based business insurance.

As a journalist and as an insurance expert, her work and insights have been featured in Forbes Advisor, Kiplinger, Lifehacker, MSN, WRAL.com, and elsewhere. Pat Howard is a managing editor and licensed home insurance expert at Policygenius, where he specializes in homeowners insurance. His work and expertise has been featured in MarketWatch, Real Simple, Fox Business, VentureBeat, This Old House, Investopedia, Fatherly, Lifehacker, Better Homes & Garden, Property Casualty 360, and elsewhere.

Coverage for business personal property inside a secondary location, such as a storage facility, is also covered. The information contained on this page should not be construed as specific legal, HR, financial, or insurance advice and is not a guarantee of coverage. In the event of a loss or claim, coverage determinations will be subject to the policy language, and any potential claim payment will be determined following a claim investigation.

No comments:

Post a Comment