Table of Content

Buying a house will be one of the most exciting—and stressful—periods of your life. With housing costs and inflation on the rise, it is more important now than ever to know what you’re getting yourself into financially. Refinancing involves replacing an existing mortgage with a new mortgage loan contract. Nonetheless, borrowers should keep in mind that banks may impose stipulations governing prepayments since they reduce a bank's earnings on a given mortgage.

You can use the mortgage calculator to determine when you'll have 20 percent equity in your home. That's the magic number for requesting that a lender waive its private mortgage insurance requirement. If you put less than 20 percent down when you purchased the home, you'll need to pay an extra fee every month on top of your regular mortgage payment to offset the lender's risk. Once you have 20 percent equity, that fee goes away, which means more money in your pocket.

Treasury & payment solutions

It also computes your total mortgage payment inclusive of property tax, property insurance and PMI payments . Once you have calculated payments, click on the "Create Amortization Schedule" button to create a report you can print out. The more time you have to pay off the mortgage, the less each monthly mortgage payment will be. The portion of the purchase price covered by the borrower.

Talk with a home mortgage consultant about loan amount, loan type, property type, income, first-time homebuyer, and homebuyer education requirements to ensure eligibility. We've included some of our popular home loan rates below so you can use them in your monthly home loan payment calculations. Interest – This is the payment lenders charge for servicing your loan. Interest rates get higher the longer you take to pay back a loan.

Conforming loans vs non-conforming loans

A shorter period, such as 15 or 20 years, typically includes a lower interest rate. Modify the interest rate to evaluate the impact of seemingly minor rate changes. Knowing that rates can change daily, consider the impact of waiting to improve your credit score in exchange for possibly qualifying for a lower interest rate.

Conforming conventional loans adhere to conforming limits set by the Federal Housing Finance Agency . This is the prescribed cap on loan amounts you can borrow for conforming loans. Conforming limits may be lower or higher, depending on the location of the house. In general, residences situated in coastal areas and major cities have higher conforming limits.

How we make money

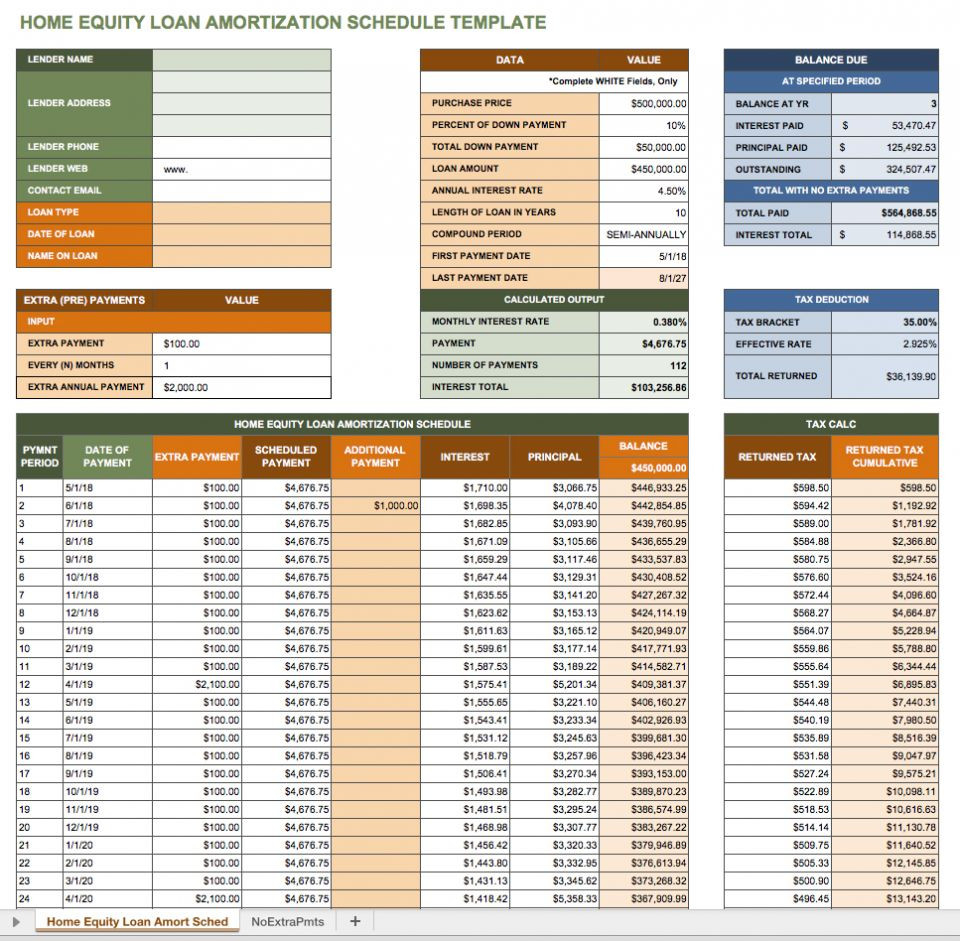

Prepayment Amount Amount that will be prepaid on your mortgage. X Prepayment Amount Amount that will be prepaid on your mortgage. Need to generate an amortization schedule for a 30 year fixed-rate conventional loan? You can save on interest charges by making extra payments. Ask your lender to apply the added payments to your principal.

Is there anything about calculating mortgage payments that you don't understand still? Mortgage lenders use your credit score as part of their formula to determine your level of risk. If you have a low credit score, you can expect to pay a higher interest rate. It is important to pay attention to your credit reports if you want to purchase a property. One key to sound money management is to pay off debts that contain higher interest rates first. For example, you could be paying 5% interest in mortgage debt and 18% in credit card debt.

Short-term mortgages typically have lower interest rates. Short-term mortgages offer less protection against changing interest rates because you need to renew them more frequently. Although there is no set time frame, the custom within the real estate industry is that mortgage pre-approval is valid for between 90 to 180 days.

Most prospective homeowners will be able to get a mortgage that is two to two-and-a-half times higher than their annual gross income. In other words, if you earn $100,000 a year, you should be able to afford a mortgage between $200,000 and 250,000. It should be noted, however, that this is a general rule.

Extra payments are additional payments in addition to the scheduled mortgage payments. Borrowers can make these payments on a one-time basis or over a specified period, such as monthly or annually. Jumbo loans are used to secure luxury homes and houses in high-cost areas. This type of financing is appropriate for high-income buyers with exceptional credit scores of 700 and above. Some lenders may even require a minimum credit score of 720.

Adjust your down payment size to see how much it affects your monthly payment. For instance, would it be better to have more in savings after purchasing the home? Compare realistic monthly payments, beyond just principal and interest. If the lender includes these possible fees in a mortgage document, they usually become void after a certain period, such as after the fifth year. Borrowers should read the fine print or ask the lender to gain a clear understanding of how prepayment penalties apply to their loan.

Overall, mortgage rates are relatively low compared to the interest rates on other loan types such as personal loans or credit cards. Hence, paying ahead on a mortgage means the borrower cannot use the money to invest and make higher returns elsewhere. In other words, a borrower can incur a significant opportunity cost by paying off a mortgage with a 4% interest rate when they could earn a 10% return by investing that money. An extra payment is when you make a payment in addition to your regular monthly mortgage payment. Extra payments can help pay off your mortgage loan sooner. The lower initial interest rate of an adjustable-rate mortgage, or ARM, can be tempting.

The principal is the amount borrowed, while the interest is the lender's charge to borrow the money. This interest charge is typically a percentage of the outstanding principal. A typical amortization schedule of a mortgage loan will contain both interest and principal. With a fixed-rate loan, a larger portion of your payment goes toward the interest during the first several years of a loan. This means your principal balance is reduced at a slow rate.

Refinancing

It calculates the remaining time to pay off, the difference in payoff time, and interest savings for different payoff options. This is the payment number that your prepayments will begin with. For a one-time payment, this is the payment number that the single prepayment will be included in. All prepayments of principal are assumed to be received by your lender in time to be included in the following month's interest calculation. If you choose to prepay with a one-time payment for payment number zero, the prepayment is assumed to happen before the first payment of the loan.